Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

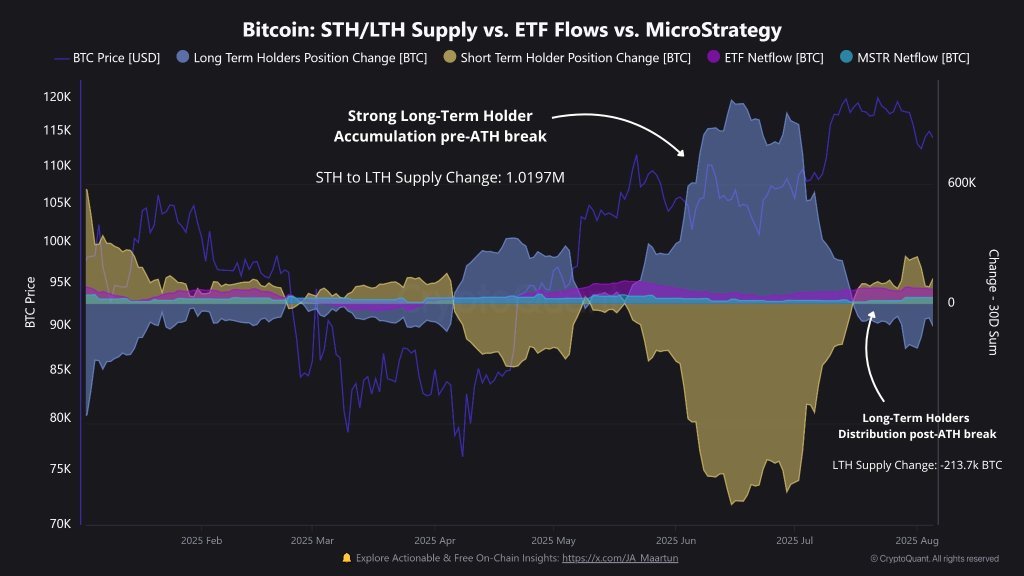

CryptoQuant analyst Maartunn used today’s price weakness to publish a granular, 10-part “Bitcoin Market Analysis” on X that dissects the post-ATH landscape with on-chain detail and a clear technical line in the sand. “Bitcoin broke its all-time high, but here’s the catch: long-term holders are [starting] to sell into the strength,” he wrote, adding that what matters now is how the market digests that supply above and around the breakout zone. In his framing, the first stress test is underway.

Is The Bitcoin Bull Run Over?

The thread anchors around one headline-grabbing datapoint: “the LTH selling pressure includes the 80,000 BTC sold by the Satoshi-era wallet.” That description is Maartunn’s interpretation of July’s extraordinary movement of eight “ancient” wallets that shifted roughly 80,000 BTC after ~14 years of dormancy via Galaxy Digital.

Beyond the drama of this single entity, Maartunn argues that behavior across the holder spectrum is what’s driving the tape. “Retail is stepping in after the ATH,” he noted, describing a familiar pattern of late-cycle enthusiasm that followed Bitcoin’s push through $120,000 in mid-July. That surge set a new record near $123,000 before momentum faded; spot prices are now revolving around $113,000–$115,000.

Related Reading

The bid didn’t vanish entirely. “Fresh capital did help the ATH-breakout buyers,” Maartunn wrote, pointing to balance-sheet demand “from firms like Strategy and Metaplanet.” Those purchases are verifiable. Strategy—the rebranded MicroStrategy—disclosed 21,021 BTC bought between July 28 and Aug. 3 at an average of ~$117,256, lifting its holdings to ~628,791 BTC. Tokyo-listed Metaplanet added 463 BTC on Aug. 4, taking treasury holdings to 17,595 BTC. Even so, those corporate flows “weren’t enough to hold Bitcoin around the ~$120k level,” the analyst said.

Where the thread turns more cautionary is on short-term hands. “Short-Term Holders started to puke and sell at a loss,” Maartunn wrote, quantifying realized-loss waves of 52,230 BTC (July 15–18), 42,493 BTC (July 24–28), and 70,028 BTC “after July 31.” He called the last episode notable “not just [for] the size, but the duration,” arguing that prolonged STH loss-realization is a pressure valve that typically needs time to exhaust. These are Maartunn’s on-chain tallies; they have not been separately published by data vendors in aggregate form.

The flows picture from listed products has begun to rhyme with that stress. “ETFs are also seeing outflows,” he observed. Multiple trackers confirm a downswing: CoinShares logged the first net weekly outflow in 15 weeks (-$223 million) with Bitcoin funds leading at -$404 million, while daily tallies this week show US spot Bitcoin ETFs bleeding for several sessions, including about -$196 million on Tuesday. Framing differs by window, but the direction is clear: the bid from ETFs is wobbling at the margin.

Related Reading

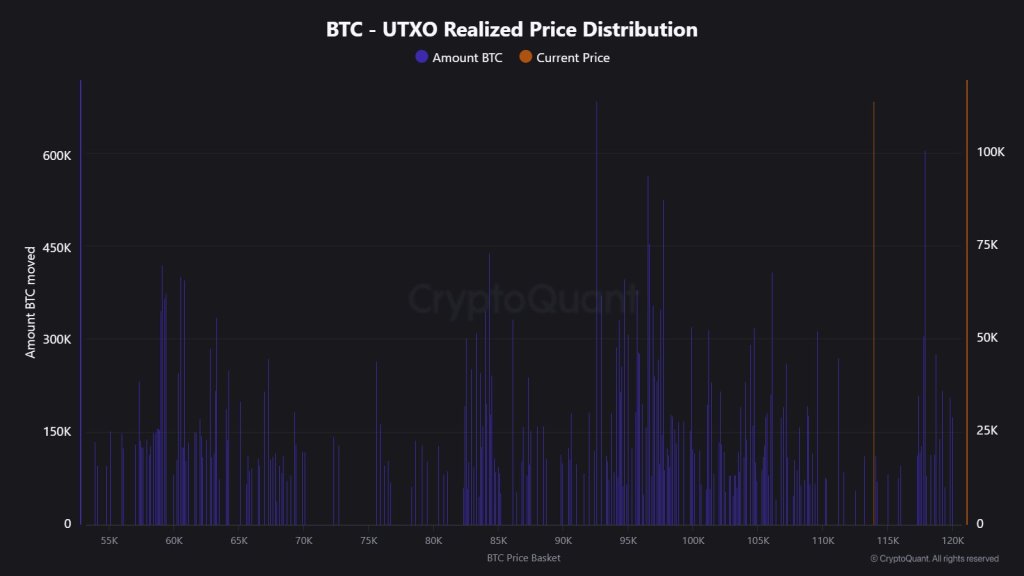

Technically, Maartunn fixes attention on the former breakout zone. “Bitcoin is finding support around its previous ATH — roughly $112K,” he wrote, pointing to a confluence between chart structure and on-chain price-distribution. His on-chain map “backs it up,” flagging “strong support in the $108K–$112K range,” an area where a large volume of coins last changed hands.

Context matters. Bitcoin’s July all-time high sits around $123,000 on major benchmarks—an extension of 2025’s institutional-heavy advance—so calling $112,000 a “previous ATH” refers to the nearer-term breakout plateau that preceded price discovery, not the absolute record. That nuance is why Maartunn concludes with a conditional: “So far this cycle, we haven’t seen any previous ATH break down… Until that changes, this looks like a normal pullback. But if we do break below a former ATH ($112k), that’s a real shift in market behavior.”

In the near term, the credibility of that ~$108,000–$112,000 “shelf” will likely be decided by whether supply from profit-taking long-term holders, loss-realizing short-term holders, and ETF redemptions continues to outweigh balance-sheet demand and organic spot inflows. If the shelf holds, Maartunn’s base case is “a normal pullback” that bleeds off excesses from the ATH push. If it fails decisively, he argues, the cycle would be showing its first meaningful breach of a prior breakout—an observable change in behavior rather than a narrative turn of phrase.

At press time, BTC traded at $114,238.

Featured image created with DALL.E, chart from TradingView.com