Bitcoin is once again at the center of market attention, trading at critical price levels after a 9% surge since the start of August pushed it to just below its $123,000 all-time high. The rally has reignited the bull-vs-bear debate, with analysts split on where BTC heads next. Some believe the momentum will be enough to break through resistance and set fresh record highs, while others warn of a looming deeper correction if buying pressure falters.

Related Reading

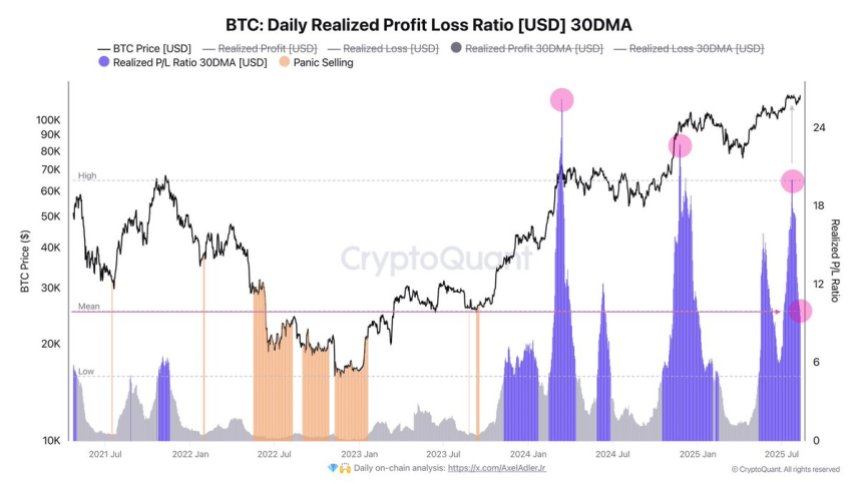

Adding to the intrigue, key data from CryptoQuant shows that despite Bitcoin’s climb to this milestone, the Realized Profit and Loss (P&L) Ratio remains close to its historical average. This metric, which measures the magnitude of gains or losses realized by market participants, suggests the current uptrend is not yet in the overheated territory that often precedes sharp reversals.

For bulls, this could indicate room for further upside without excessive risk of a rapid downturn. For bears, it’s a reminder that Bitcoin’s long-term trend remains intact but vulnerable to sudden shifts in sentiment. With volatility still defining the crypto landscape, the next moves around this level could shape Bitcoin’s trajectory for the rest of the year.

Bitcoin Faces Pivotal Test As ATH Breakout or Rejection Looms

According to top analyst Axel Adler, Bitcoin’s current market structure presents a much lower risk of a sharp trend reversal compared to previous peaks in the Realized Profit and Loss (P&L) Ratio. In past cycles, this metric often spiked to overheated levels before major pullbacks, signaling that market participants were taking excessive profits all at once.

Today, however, the P&L Ratio remains closer to its average range, indicating a more balanced market environment despite Bitcoin trading just below its $123,000 all-time high. This suggests that while volatility remains a constant in the crypto space, the immediate probability of a dramatic downturn is lower than in past overheated phases.

Still, Adler emphasizes that Bitcoin is entering a critical price range where market direction will be decided. Breaking above the all-time high is essential for the uptrend to continue, as such a move would likely trigger a new wave of momentum buying and potentially set the stage for fresh record highs. On the other hand, failing to clear this level—especially after multiple attempts—could result in a sharp correction or an extended period of sideways consolidation, testing investor patience.

Other analysts highlight the contrast between Bitcoin’s strong long-term fundamentals and the current market indecision. On-chain data points to healthy accumulation trends, steady network activity, and relatively contained leverage in derivatives markets—all signs of underlying strength. Yet, uncertainty over macroeconomic conditions, regulatory developments, and short-term profit-taking continues to weigh on sentiment.

Related Reading

BTC Price Analysis: Testing Critical Resistance

Bitcoin’s price action shows a decisive rally since early August, climbing nearly 9% and approaching the all-time high at $123,217.39. On the 8-hour chart, BTC faced strong rejection near this resistance, pulling back to the $118,500 area. The recent move marks the second approach toward this level in the past three months, highlighting its importance as a critical breakout point.

The chart also reveals that BTC remains above its key moving averages — the 50 SMA ($116,605), 100 SMA ($117,340), and 200 SMA ($112,019) — reinforcing the underlying bullish structure. The 50 SMA has recently crossed above the 100 SMA, a short-term bullish signal suggesting continued upward momentum if buyers can sustain pressure.

Related Reading

However, the failure to break above the $123K level could lead to renewed selling pressure, with potential retracements toward the 100 SMA or even the 200 SMA if momentum fades. A confirmed breakout above $123K would likely trigger a new wave of buying, pushing BTC into price discovery and setting fresh record highs.

Featured image from Dall-E, chart from TradingView