As Bitcoin (BTC) continues to hover in the high $110,000 range, on-chain data suggests that a short-term price pullback may be imminent. That said, the broader market structure remains firmly bullish.

Bitcoin Exchange Reserves Hit Near-Month High

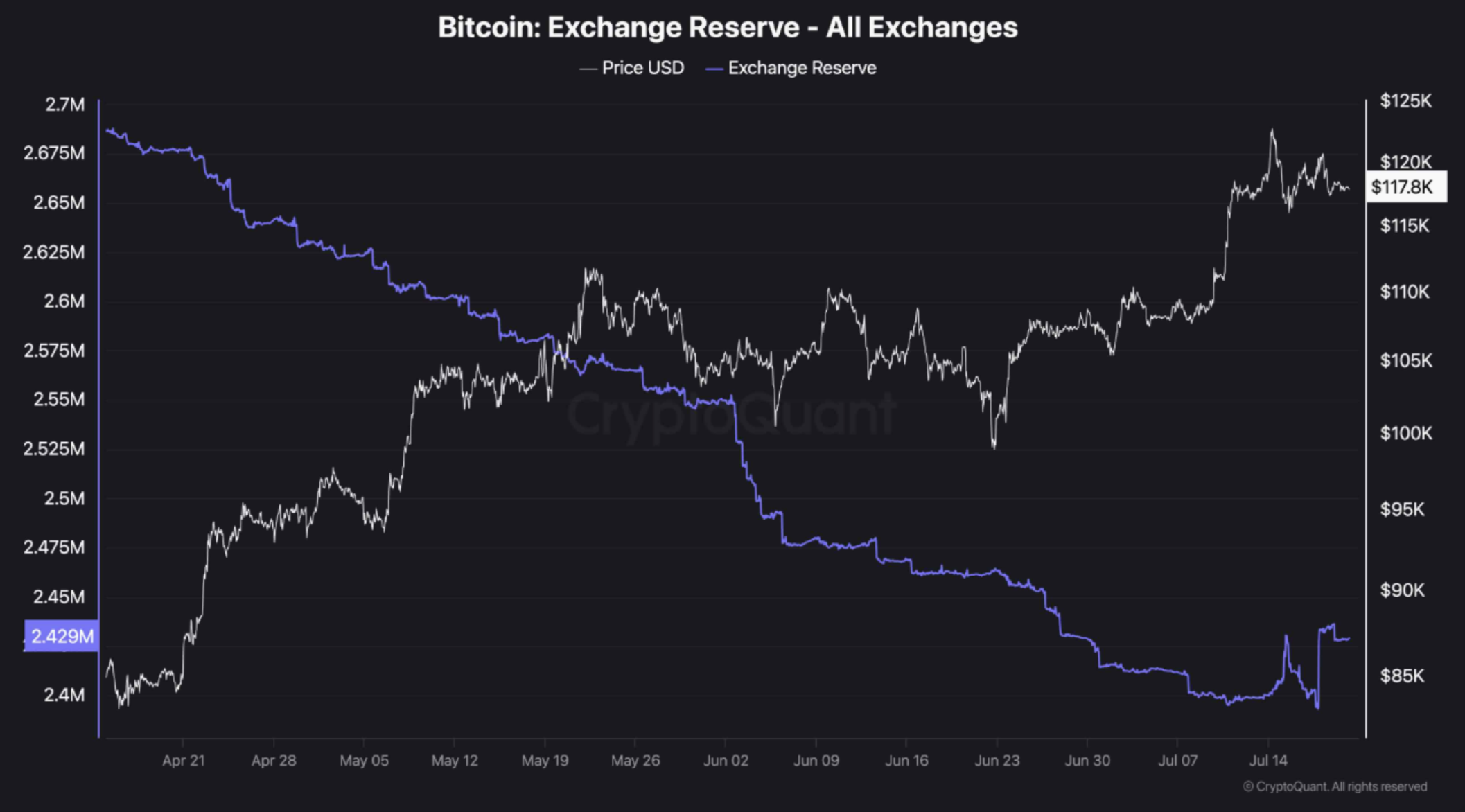

According to a recent CryptoQuant Quicktake post by contributor ShayanMarkets, BTC reserves on centralized exchanges have risen to their highest level since June 25. This surge in exchange-held Bitcoin may signal increasing profit-taking activity among investors.

Related Reading

A rise in BTC inflows to exchanges typically precedes distribution phases, as more coins become available for potential sale. This shift is often interpreted as a weakening in buy-side pressure, which could lead to a short-term price decline. ShayanMarkets commented:

Historically, rising exchange reserves are associated with local market tops, as more BTC becomes available for potential sale. However, this metric alone should not be seen as a definitive trigger for immediate price drops. Broader market liquidity, sentiment, and demand dynamics remain key.

The analyst emphasized that while higher reserves may suggest short-term selling pressure, they don’t necessarily indicate a reversal in trend. Any correction should be evaluated in context, unless accompanied by a significant change in macroeconomic or technical indicators.

In a separate CryptoQuant post, analyst Darkfost pointed out a sharp uptick in Bitcoin whale activity. Notably, the last two Bitcoin local tops occurred when monthly average inflows from whales exceeded $75 billion.

Between July 14 and July 18, average monthly inflows from whale wallets surged from $28 billion to $45 billion – a $17 billion jump. This pattern suggests that some whales may be taking profits following Bitcoin’s recent all-time high of $123,218 on Binance.

What Does On-Chain Data Suggest?

On-chain data also shows that long-term holders are distributing their BTC, while short-term holders are increasingly accumulating. This kind of rotation is often associated with late-stage rally behavior and potential exhaustion.

Related Reading

Still, the short-term holder Market Value to Realized Value (MVRV) ratio currently sits at 1.15, well below the typical profit-taking threshold of 1.35. This suggests that there may still be room for further price appreciation before a broader selloff begins.

However, not all indicators are reassuring. The Bitcoin NVT Golden Cross – a metric that compares network value to transaction volume – is trending higher, which may point to growing market froth.

Likewise, exchange data from Binance indicates that BTC could be facing a near-term pullback. At press time, Bitcoin trades at $118,052, down 0.4% over the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com