The Oct. 10–11 sell-off that erased an estimated ~$19–20 billion across crypto within 24 hours has ignited a fierce post-mortem over whether market structure—or malice—turned a macro shock into cascading liquidations.

Crypto Crash Not Random?

On X, Uphold’s head of research Dr. Martin Hiesboeck alleged the crash “is suspected to be a targeted attack that exploited a flaw in Binance’s Unified Account margin system,” arguing that collateral posted in assets such as USDe, wBETH and BnSOL “had liquidation prices based on Binance’s own volatile spot market, not reliable external data,” which allowed a cascade once those instruments depegged on Binance order books. He added that the episode “was timed to exploit a window between Binance’s announcement of a fix and its implementation,” calling it “Luna 2.”

The crypto market crash on October 11 is suspected to be a targeted attack that exploited a flaw in Binance’s Unified Account margin system.

The issue stemmed from using assets like USDE, wBETH, and BnSOL as collateral, whose liquidation prices were based on Binance’s own…

— Dr Martin Hiesboeck (@MHiesboeck) October 12, 2025

Binance has publicly acknowledged extraordinary price dislocations in exactly those instruments during the crash window and has committed to compensating affected users. In a series of notices published Oct. 12–13 (UTC), the exchange said that “all Futures, Margin, and Loan users who held USDE, BNSOL, and WBETH as collateral and were impacted by the depeg between 2025-10-10 21:36 and 22:16 (UTC) will be compensated, together with any liquidation fees incurred,” with the payout “calculated as the difference between the market price at 2025-10-11 00:00 (UTC) and their respective liquidation price.” Binance also outlined “risk control enhancements” after the incident.

Related Reading

The depegs were violent on Binance’s books: USDe printed as low as roughly $0.65, while wrapped staking tokens wBETH and BNSOL also plunged, briefly gutting the collateral value in Unified Accounts and triggering forced unwinds. Third-party market coverage and exchange community posts documented those prints and the immediate knock-on to margin balances during the 21:36–22:16 UTC window.

Hiesboeck later framed the chain of events as leverage meeting brittle collateral mechanics rather than pure price discovery. In a follow-up explainer, he wrote: “The Trigger: It all started with external shock. A political post (Trump’s new tariff threat) hit the US stock market, and that fear spilled directly into crypto… The Amplifier: …too many people using massive leverage… Domino Effect: …panic selling hit related assets that were supposed to be stable (like USDe and wBETH), causing them to ‘depeg’… The Lesson (and Binance’s Role): Analysts say the true issue was not an attack, but bad design… [the] system dumped [collateral] immediately at any price.” He added that “Binance is now preparing a huge compensation plan.”

Related Reading

Macro shock is, in fact, a credible first domino. The Oct. 10–11 liquidation wave was triggered by new tariff threats from the US President Donald Trump against China, which sparked cross-asset risk-off and an aggressive deleveraging across crypto perps. Friday’s crash was the “largest ever” liquidation event with roughly $20 billion in liquidations in a single day, with more than $1.2 billion of trader capital erased on Hyperliquid alone.

Where the debate turns technical is on the “exploit” claim. One camp points to a design gap in how Binance’s Unified Account treated certain collateral: rather than anchoring to robust external pricing, liquidation thresholds referenced internal spot pairs that became thin and disorderly precisely when they were most system-critical. That design, critics argue, created a reflexive loop in which depegging collateral forced liquidations that sold more of the same collateral back into the same unstable books.

Binance, for its part, has said it will adjust pricing logic for wrapped assets and has begun compensating users who were liquidated or suffered verified losses during the specified window. Ethena’s team, whose synthetic dollar USDe was at the center of the move, contends the problem was localized to Binance’s pricing/oracle path rather than a fundamental break in USDe’s mechanism.

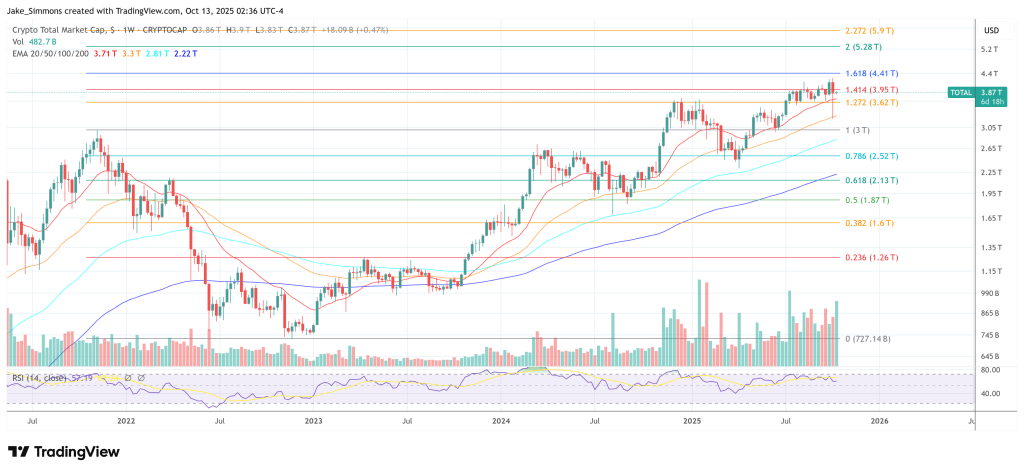

At press time, the total crypto market cap recovered to $3.87 trillion.

Featured image created with DALL.E, chart from TradingView.com