Ethereum (ETH) has been facing heightened volatility over the past week, following a sharp correction from its recent local high at $3,940 down to $3,360. After weeks of aggressive buying activity and bullish momentum, the market is now showing signs of fatigue. Analysts are growing cautious, with many warning that a deeper correction could be imminent if Ethereum fails to reclaim key support zones.

Related Reading

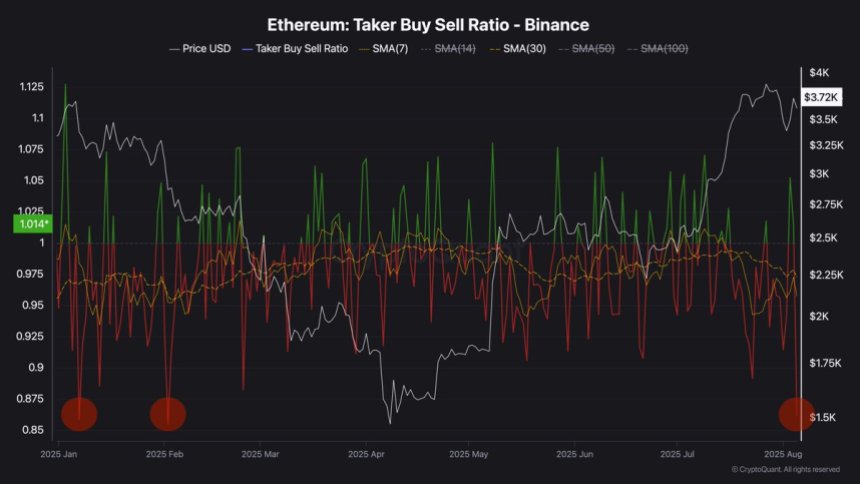

Adding to these concerns, fresh data reveals a significant shift in market dynamics. The taker buy/sell ratio — a key indicator that tracks the aggressiveness of buyers versus sellers — has sharply declined into negative territory today. This signals that sellers are currently dominating the order books, applying sustained pressure on ETH’s price action.

While some view this as a typical cooldown phase after a major rally, others believe Ethereum is entering a riskier phase where bearish sentiment could intensify if support fails to hold. The coming days will be critical in determining whether ETH stabilizes around current levels or slides further into correction territory.

Ethereum Faces Short-Term Selling Pressure

According to top analyst Darkfost, Ethereum’s taker buy/sell ratio has dropped sharply into negative territory today, reaching 0.87—one of the lowest levels recorded since the start of the year. This metric, which measures the ratio of aggressive buyers to sellers in futures markets, reveals that selling pressure is now firmly in control of ETH’s order books.

Although today’s data is still incomplete, the current reading already indicates a dominance of sell orders on Ethereum futures. Darkfost notes that this shift has been developing for several weeks. Since July 18th, the taker buy/sell ratio has been mostly negative, which correlates with Ethereum’s recent inability to break through key resistance levels and its transition into a short-term consolidation phase.

While this may seem concerning for bullish traders, Darkfost emphasizes that such consolidations are a normal part of market cycles, especially after a strong rally. He suggests that Ethereum could face a challenging period in the short term, as market sentiment remains fragile and sellers continue to control intraday movements.

Related Reading

However, this phase might offer a healthy foundation for the next leg up. If Ethereum manages to stabilize and consolidate above critical support zones, the broader trend remains favorable. Long-term fundamentals, including on-chain accumulation and growing institutional interest, still point toward upside potential once this phase of selling pressure eases.

Price Analysis: Bulls Attempt Recovery After Sharp Decline

Ethereum is currently trading at $3,654.60, attempting to stabilize after a sharp correction from its recent highs around $3,940. The 4-hour chart shows a recovery bounce that met resistance near the 50-period SMA (currently at $3,668.28), signaling that bulls are facing strong selling pressure at this level.

Despite the bounce, ETH remains below the key horizontal resistance at $3,860.80, which has capped multiple upward attempts in recent weeks. The bullish attempt to reclaim momentum earlier today was rejected near this level, leading to a quick retracement back into the $3,600-$3,650 zone.

The 100-period SMA (green line) at $3,695.32 is acting as dynamic resistance, while the 200-period SMA (red line) at $3,303.42 serves as a longer-term support level should the correction deepen.

Related Reading

Volume spikes indicate that buyers are stepping in aggressively on dips, but overall, Ethereum remains in a short-term consolidation phase between $3,850 and $3,350. A decisive breakout above $3,860.80 is required to regain bullish momentum, while failure to hold above $3,600 could expose ETH to another retest of lower support levels around $3,300-$3,350.

Featured image from Dall-E, chart from TradingView