The Stablecoin market is once again proving to be one of the most important indicators for crypto recovery after one of the most violent crashes in recent history. On Friday, Bitcoin plunged to $103,000 within minutes, triggering a wave of panic across the market as overleveraged positions were wiped out and Altcoins lost more than 80% of their value in the same period. The sudden correction left investors questioning whether this marked the end of the bull phase or simply a reset before the next leg up.

Related Reading

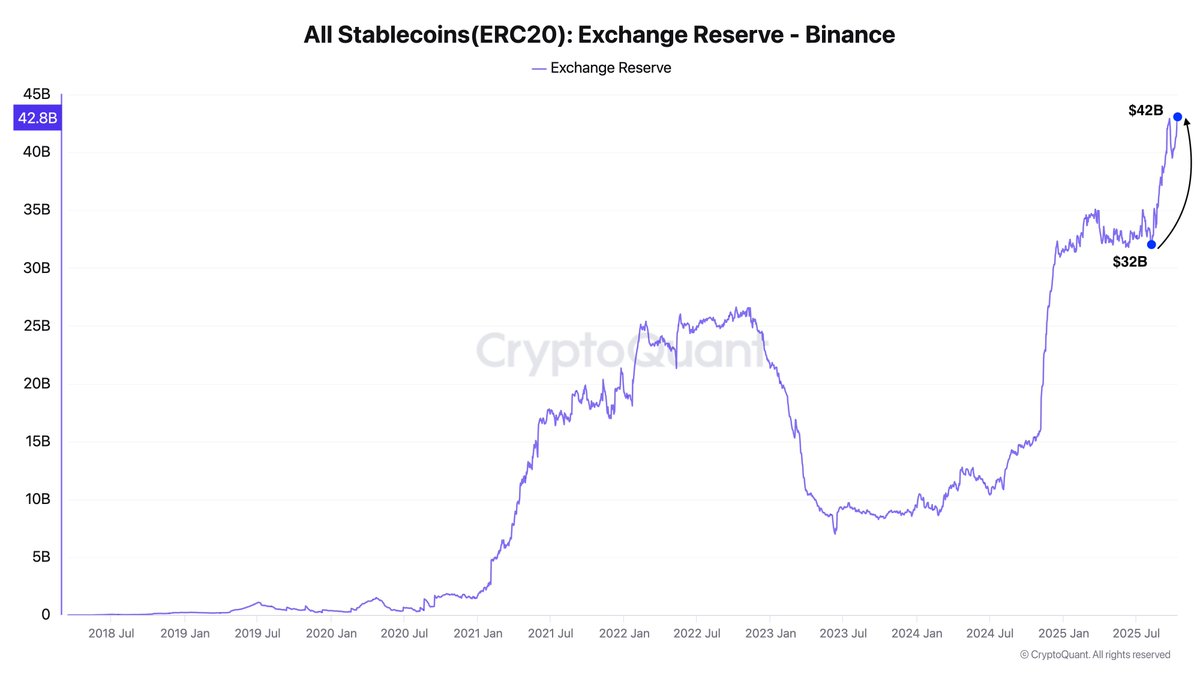

Despite the chaos, key onchain data paints a more optimistic picture. Top analyst Darkfost highlights that the supply of ERC-20 stablecoins continues to grow, especially on Binance, the exchange that remains the undisputed leader in trading volume. This surge in stablecoin reserves suggests that liquidity is quietly rebuilding beneath the surface, as investors prepare for re-entry rather than full-scale retreat.

In crypto cycles, rising stablecoin balances often act as a precursor to renewed buying pressure, indicating that capital is sitting on the sidelines, waiting for the right moment to return. As volatility cools down, the stablecoin supply could play a decisive role in shaping the market’s next major move.

Liquidity Surges As Binance Hits Record High Reserves

Darkfost shared data showing that the ERC-20 stablecoin supply on Binance has seen a massive surge over the past two months, rising by $10 billion since August, from $32 billion to $42 billion. This marks the highest level of ERC-20 stablecoin reserves ever recorded on the exchange, a significant milestone that signals renewed liquidity inflows into the market.

This sharp increase in stablecoin reserves suggests two major dynamics at play. First, investors continue to deploy capital into the crypto market through stablecoins, a common precursor to renewed accumulation and trading activity. Second, Binance’s dominance in global trading volume remains unchallenged, with increasing user participation demanding more available liquidity on the platform.

While part of this increase may stem from investors rotating capital back into stablecoins after the recent market crash, this explanation alone doesn’t capture the full picture. Binance typically adjusts its reserves in response to active trading behavior, meaning this spike is more likely linked to rising demand and capital readiness than to risk aversion.

Despite recent volatility and sharp liquidations, the data show that liquidity is flowing back in, positioning the market for a potential rebound. If this trend continues, stablecoin accumulation on Binance could serve as the foundation for the next major leg up across Bitcoin and the broader crypto ecosystem.

Related Reading

Stablecoin Dominance Spikes: Capital Rotates After Market Crash

The chart shows a sharp rise in stablecoin dominance, which recently spiked above 9% before cooling to around 8.15%. This move reflects a rapid flight to liquidity following last week’s extreme volatility, when Bitcoin plunged below $105K and altcoins saw significant losses. Historically, such spikes in stablecoin dominance indicate that traders are exiting risk assets to hold stablecoins, waiting for market stabilization before redeploying capital.

Interestingly, the pullback from 9% to 8% suggests that the panic phase may already be easing. The market appears to be entering a reaccumulation phase, where stable capital is preparing for the next major move. On a technical level, stablecoin dominance remains well above its 50-day and 200-day moving averages, signaling persistent strength in liquidity reserves.

Related Reading

If dominance continues to consolidate near these highs while Bitcoin stabilizes, it could create the foundation for renewed inflows into risk assets. In other words, money hasn’t left the market—it’s waiting on the sidelines. Stablecoin dominance above 8% generally marks periods of strong capital positioning, often preceding new market uptrends. The current setup, therefore, highlights growing investor caution but also a buildup of dry powder that could soon reenter the market.

Featured image from ChatGPT, chart from TradingView.com