Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

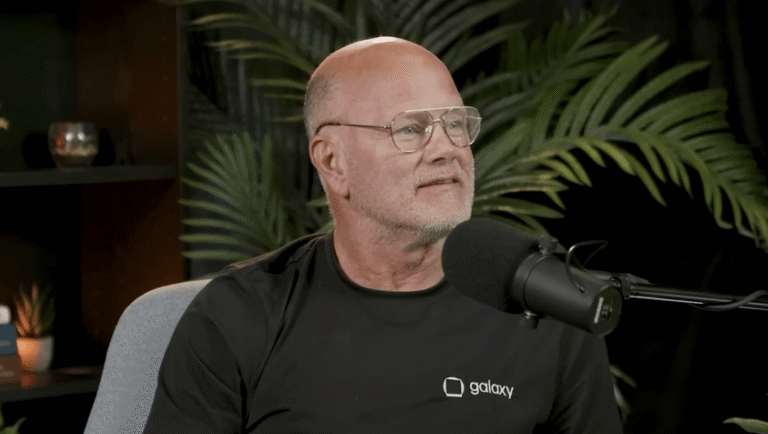

Mike Novogratz believes Bitcoin’s path to $1 million is powered by two engines—grassroots adoption and an unforgiving macroeconomic backdrop—and he would rather the ascent be measured than manic. “Bitcoin has two vectors that drive its valuation. One is adoption, right? How many people get orange-pilled? And the other is the macro environment,” the Galaxy CEO told Natalie Brunell in an August 12 interview on Coin Stories, adding that persistent fiscal profligacy across major economies remains a powerful tailwind.

Novogratz Sees $1M Bitcoin Ahead

Novogratz framed today’s market as the product of a decade of cultural and institutional conversion. On the cultural side, he argues that the social consensus around Bitcoin is now self-sustaining: “Some collection of first kooky people and then less kooky people and then all of us a little have successfully orange-pilled enough people that Bitcoin has value because we say it does.” On the institutional side, he singled out the moment the chief executive of the world’s largest asset manager embraced the asset class. “There’s before Larry Fink and after Larry Fink,” he said, praising the conversion of a once-skeptical standard-bearer as the symbolic turning point: “He blessed it as a real asset and it’s on the screen of every macro trader in the world.”

Related Reading

The second engine is macro. Here Novogratz is blunt. He expects continued fiscal deterioration—regardless of political promises—to keep debasing fiat and, by extension, underwriting Bitcoin’s scarcity premium. “We have governments that can’t keep their pants on. They spend more money than they should… And you know what? The deficit’s going to be higher, not lower,” he said. In his telling, Bitcoin functions as both “report card” and governor on policymaking: the worse the stewardship, the stronger the bid for digital gold.

The destination, in his view, is not in doubt. The route matters. “I think we will get to a million. I just hope we get there slowly,” Novogratz said. A disorderly sprint to seven figures, he warned, would likely reflect domestic or global dislocation: “People that cheer for the million-dollar Bitcoin price next year… it only gets there if we’re in such a [shitty] place domestically.” He prefers a glide path where adoption compounding meets macro drift, not panic.

That stance informs his take on Bitcoin’s role and narrative. He wants Bitcoin to “stay in its lane” as digital gold—“the blockchain tailor-made for money”—and resists efforts to make it all things to all use cases. “The narrative is so clean when you say it’s digital gold,” he said, arguing that clarity invites the broadest acceptance from institutions and the public. That clarity has already translated into infrastructure: spot ETFs and traditional-market rails that deepen liquidity and lower frictions for allocators.

Liquidity, he noted, has scaled to the point where even very large transfers can be absorbed with limited impact. Without naming the client, he acknowledged Galaxy’s execution of a high-profile sale of 80,000 BTC in the interview and observed that “the market held up very well… it barely made a blip.” For him, the episode illustrates the maturing of Bitcoin’s market structure—precisely the condition needed for large treasuries, lenders, and derivatives desks at “traditional firms [that] are going to start by lending against Bitcoin and Ethereum” to participate without destabilizing prices.

Related Reading

Cycle-wise, Novogratz still sees room to run, though he is watching for signs of froth. “We’re getting five calls a week on new… balance sheet companies. At one point that’s what bubbles feel like,” he said. Even so, his “gut feeling” is for “one more leg up” with a potential ramp into the fourth quarter, helped by perceptions of an increasingly dovish Federal Reserve. He also reminded listeners that “the last gasp of the bull market is often the most violent upward… and we’re not there yet.”

Despite his decades as a macro trader, Novogratz anchors his own crypto allocation with conservative asymmetry: “People ask me all the time… I’ve been roughly 70/30—70% Bitcoin, 30% other.” For newcomers outside crypto, he now sees room for materially higher exposure than in years past, citing the industry’s maturation. But all roads, in his framing, still lead back to Bitcoin’s dual-engine thesis: broaden the tent and let macro do the rest.

“Adoption means orange-pilling people,” he said. “The more people we have bringing people into the tent, the price goes up.” The macro engine is unlikely to stall any time soon. The combination, he argues, is what ultimately propels Bitcoin to seven figures—ideally by steady climb, not crisis.

At press time, BTC traded at $119,743.

Featured image created with DALL.E, chart from TradingView.com